Legal & Regulatory Compliance Framework

Karpous is designed as a regulated, globally compliant investment platform that bridges the reliability of traditional finance with the efficiency of digital infrastructure. We operate under clear legal frameworks that protect investors, ensure transparency, and prevent misuse.

From the moment you sign up to the moment you redeem, every transaction, contract, and yield flow is governed by structured compliance. Our approach can be summarized in three principles:

Legal Clarity

Every asset has an enforceable ownership and yield structure.

Regulatory Alignment

Every jurisdiction is respected.

Investor Protection

Every participant's rights are preserved and verifiable.

Asset Structuring Under Regulated Jurisdictions

Each real-world asset listed on Karpous is legally structured under a Special Purpose Vehicle (SPV) or a trust-based holding entity, depending on the jurisdiction. This ensures that investor funds are always segregated from operational funds and that the ownership structure remains enforceable.

This model guarantees that investor claims are legally recognized and enforceable in traditional courts not just on digital ledgers.

Jurisdictional Licensing and Oversight

Karpous operates in collaboration with licensed financial service providers and registered custodians in compliant regions. While Karpous is a technology and facilitation platform, all asset custody, fund flow, and yield distribution occur under regulated entities.

Investors onboard through licensed partners that handle KYC and fund settlement.

Yield and redemption flows are processed through regulated payment rails

Karpous maintains oversight across all counterparties, ensuring compliance and consistency across borders.

Our ecosystem is modular but unified: every actor – operator, custodian, or investor – is accountable under the same compliance architecture.

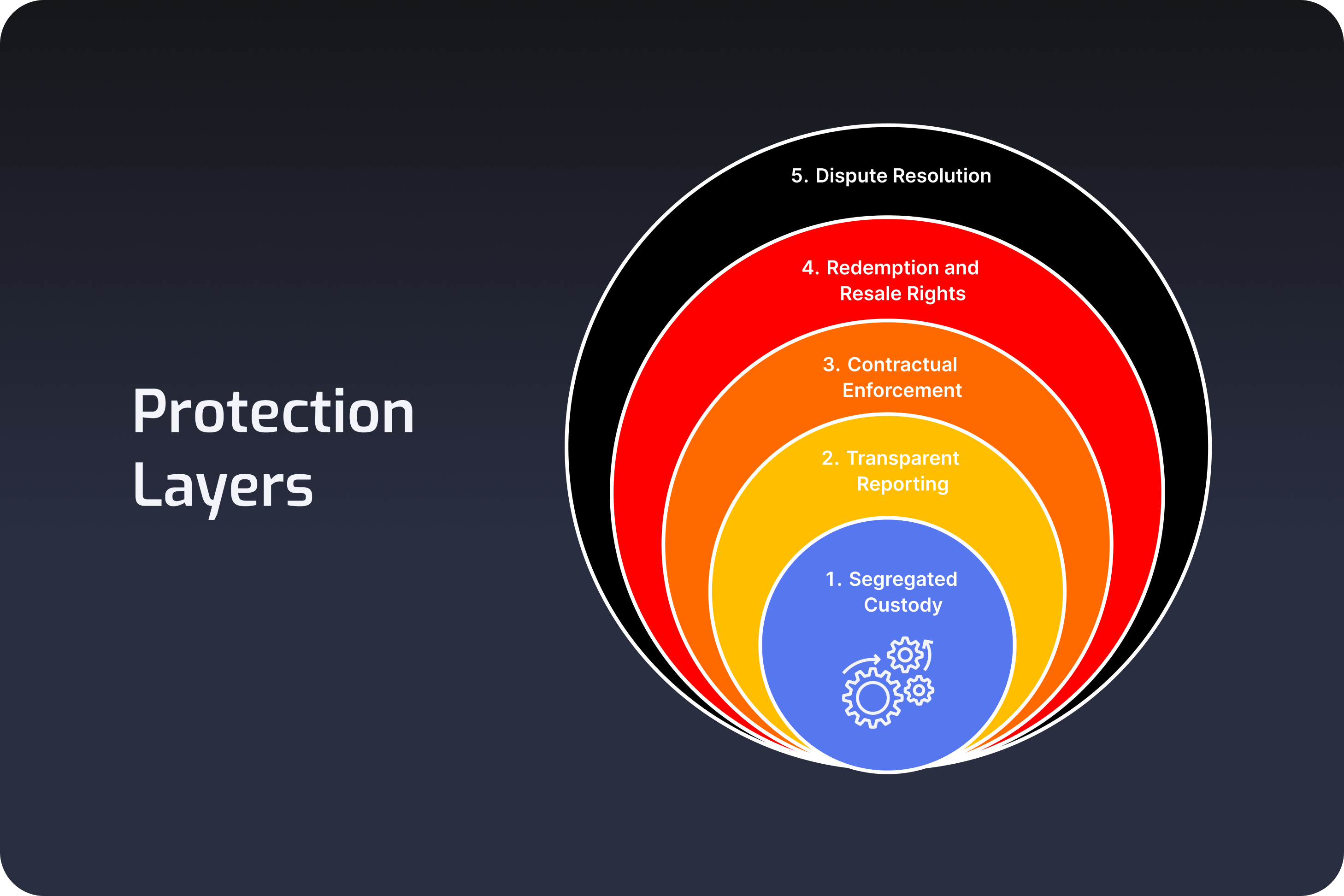

Investor Protection Framework

Investor protection is built into Karpous's structure, not bolted on later.

- Segregated Custody

Investor assets are never pooled with operational funds. - Transparent Reporting

Every investment includes public-facing Fact Sheets and live performance dashboards. - Contractual Enforcement

Digital certificates correspond to legally binding contracts enforceable in regulated jurisdictions. - Redemption and Resale Rights

Investors retain continuous liquidity via market-based exits, ensuring they're never trapped by redemption windows. - Dispute Resolution

Clear dispute channels are defined within each jurisdiction's SPV agreements, supported by arbitration mechanisms.

This ensures that every participant — from retail user to institutional investor — operates with equal clarity of rights and protection.

Governance and Audit Oversight

Karpous enforces strict audit and oversight mechanisms across its operations:

Internal Governance

Quarterly compliance reviews and internal audits.

Third-Party Audits

Annual audits by independent legal and financial firms.

Asset Verification

Real-world asset verification through periodic reporting, geolocation, or operational data feeds.

Exchange Monitoring

Ongoing AML/CFT checks across all trades to detect irregular patterns.

Transparency reports are published quarterly, summarizing platform-level data, total assets under management, yield distributions, and KRPS buyback metrics.